ART JOSETTI

HNI Account Executive

Many in the insurance industry believe it's time to pass a long-term extension for the terrorism insurance law. The Terrorism Risk Insurance Program Reauthorization Act is set to expire Dec. 31, 2014, and industry representatives and legislators have been vigorously debating the act this fall.

What's TRIPRA and Why Does it Matter?

TRIPRA was passed in 2002 in the aftermath of the 9/11 terrorism attacks. After the attacks, it was critical that terrorism insurance be available. In a nutshell, TRIPRA spreads around the cost of acts of terrorism between insurers and the federal government. The government pays for 85 percent of coverage for terrorist attacks if damages are greater than $100 million. The government can earn back losses by charging insurers.

There is a real possibility that it may go away or be changed dramatically. If this act expires, the sharing of claim costs goes away. This is a big deal because businesses likely will lose coverage for acts of terrorism. Why? A big reduction in insurance capacity, brought on by the expiration of TRIPRA, probably would cause the cost of terrorism coverage to increase significantly. If businesses can't afford terrorism coverage and go uninsured, their lender contracts and lines of credit would be compromised.

There is a real possibility that it may go away or be changed dramatically. If this act expires, the sharing of claim costs goes away. This is a big deal because businesses likely will lose coverage for acts of terrorism. Why? A big reduction in insurance capacity, brought on by the expiration of TRIPRA, probably would cause the cost of terrorism coverage to increase significantly. If businesses can't afford terrorism coverage and go uninsured, their lender contracts and lines of credit would be compromised.

This domino effect of no insurance-no funding would be especially bad for the construction industry. In the larger scheme of things, when the construction industry slows, fewer jobs are added and the economy slows.

Many insurance carriers in the private market likely will drop terrorism coverage if TRIPRA expires because of the high cost of taking over all terrorism risk. Small- and mid-sized insurance companies would be most likely to not offer terrorism coverage.

Digging Into the Terrorism Insurance Issue

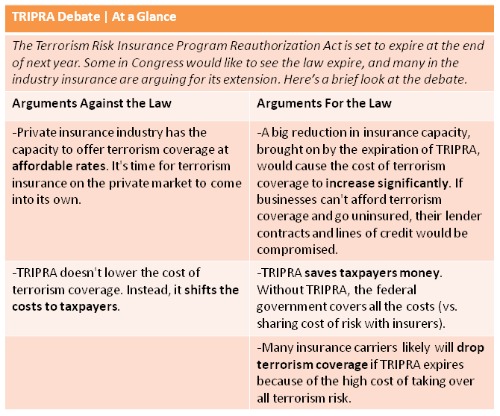

Advocates for letting TRIPRA expire hold that the private insurance industry has the capacity to offer terrorism coverage at affordable rates, and that it's time for terrorism insurance on the private market to come into its own. The argument also has been made that TRIPRA doesn't lower the cost of terrorism coverage, but that it instead shifts the costs to taxpayers. Supporters of TRIPRA point out that the act actually saves taxpayers money. With the law in effect, the cost of covering acts of terrorism is shared between the federal government and the insurance industry. Without TRIPRA, the federal government covers all the costs.

Some of those in favor of TRIPRA's expiration equate terrorism risk with natural disaster risk, however, natural disaster coverage is based on historical data — and there's a lot of it for insurance modelers to use! Fortunately, there's not nearly the same volume of data for terrorist events. What's more, natural disasters don't involve planning, while terrorist events are plotted and executed by individuals. Actors in terrorist events also have motives affected by government actions, and insurance modelers don't have access to that information — all of which makes pricing terrorism risk very tricky.

Opponents of TRIPRA also argue that the act encourages businesses to stay in high-risk locations — chiefly the East and West coasts. The implication is that only the nation's most densely populated areas are susceptible to terrorism. The fact is that any venue that brings together lots of people (for example, a hospital full of patients, a sold-out sports area, or a university campus) could be a target of terrorism.

Expect More Action on TRIPRA in Spring 2014

As for next steps, our leaders in Washington likely won't pick up the TRIPRA issue again until next spring. Insurers were warned that renewal of the act, if it happens, likely won't take place until late 2014. Insurance insiders say they won't be surprised if the decision runs up against the expiration deadline as it has in the past.

Where do you stand when it comes to TRIPRA? Are you in favor of Congress renewing the act or letting it expire in 2014? Share your thoughts in the comments!

Related Posts:

Business Income Insurance: Your Frenemy

7 Reasons Why Insurance is Important

.png?width=69&height=53&name=Acrisure%20Logo%20(White%20Horizontal).png)

![[ GET THE RECORDING ] Business Insurance Bootcamp](https://no-cache.hubspot.com/cta/default/38664/38b6679e-0c20-4f80-aeed-b80bac8b0023.png)