Everything about running a transportation company is a little more complicated now – from hiring great drivers, to improving safety performance, to preparing the next generation of leaders.

In our work with hundreds of different transportation companies, what we've found is that this increased complexity has led to two key things happening:

1) there are more hidden risks in your business than ever before, and

2) the companies that address these hidden risks are outperforming everyone else.

THE OPPORTUNITY:

If there's one thing we know about our clients, it's that if there’s any way to improve their business, they want in. So, for the past 6 months, we’ve been working on a way for high-performing transportation companies to come together and face these challenges head on.

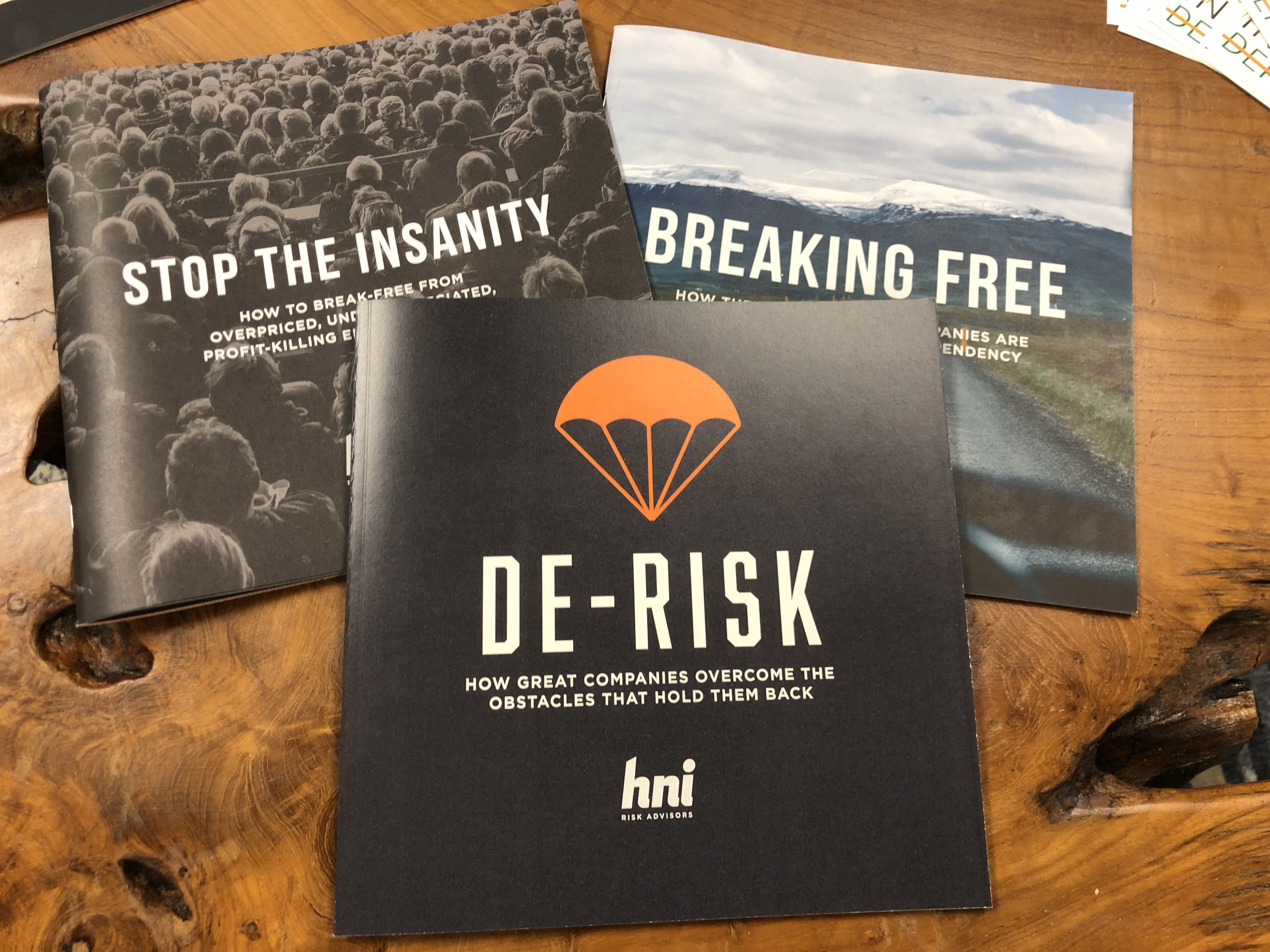

It’s called The DE-RISKING Network. And here’s what it’s all about:

1. Bumping elbows with other high-performers. It's amazing what happens when you get a group of high-performers in the same room to tackle really difficult challenges.

2. Focusing on what actually makes an impact. We believe that focusing on Leadership, Culture, and Operations has the greatest potential to increase the value of your company, so that’s where we’ll spend our time.

3. Hearing from the country’s best experts. We’re bringing in the country’s leading experts to deliver content both digitally and in-person at events like the annual DE-RISKATHON member retreat (i.e. US Navy SEALS).

4. Preparing the next generation of leaders. The future performance of your company rests in the hands of the next generation of leaders. This program will be a way for current and future leaders to share a common learning experience and refine their skills.

If you’re interested, you can learn more about The DE-RISKING Network here.

Now through May 1st, you can join for a reduced membership fee, which includes the annual DE-RISKATHON member retreat on June 11th and 12th in Milwaukee.

.png?width=69&height=53&name=Acrisure%20Logo%20(White%20Horizontal).png)